Edu 4: Repo Markets

In this issue, we will delve into the mechanics behind repo and introduce the US repo markets.

In this issue of education pieces, I will delve into the repo markets and examine the different repo regimes in the world.

Let us start with the basics, what is a repo? Repo or repurchase agreement is synonymous with a collateralized loan. It is a sale of the security, or a portfolio of securities combined with an agreement to repurchase them on a specified date at a pre-determined price.

Take a hedge fund for example. In the opening leg, the fund needs cash to fund a portfolio of securities. To get cash, the fund repos out a treasury holding to receive cash. The counterparty can be MMFs, asset managers, securities lending agents or any investors that are looking to obtain specific securities as collateral in order to hedge or speculate.

In the closing leg, the transaction is reversed where the security is repurchased by the hedge fund and the cash returned to the cash provider.

This example is a bilateral repo transaction.

Fig 1: Typical Repo Transaction (FRBNY)

Note that in this scenario, it is a repo transaction for the hedge fund, and it is a reverse repo transaction for the counterparty.

Another key concept that is imperative to repo would be the repo rate, haircuts, and variation margins.

Repo Rate

To illustrate the repo rate, take an insurance giant (repo seller) for example. It repos out US$100M face value worth of USTs to an MMF(repo buyer) , but its market value is “109 – 28 ¾”, that is 109 + 28.75/32 = 109.898438 for every 100 face value. This happens when the UST’s coupon rate is below the yield.

In essence, the insurance giant is repoing out its securities at face value, note here we disregard haircuts. It receives US$109,898,438 in return from the MMF.

Fig 2: Initiation of Repo (Wiley Finance)

Assuming that the repo rate is 0.015% (i.e. in the era of ZIRP of 2022), and the duration of the repo agreement is 44 days. When the transaction is unwind/reversed, the insurance giant pays US$109,900,452 to the MMF and receives its collateral back.

US$109,898,438 X (1 + (0.00015 X 44/360)) = US$109,900,452.

Fig 3: Unwinding of Repo (Wiley Finance)

Besides having collateral to protect the cash provider (i.e. repo buyer) against defaults, they’re protected even further by safe harbors – haircut & variation margin.

Haircut

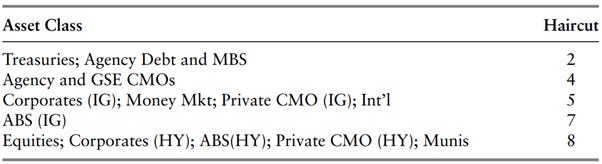

At a haircut of 2%, collateral value is reduced by 2% when considered against the loan amount. Take treasuries for example, the repo seller can only borrow up to US$98 against a treasury worth US$100, leaving a margin of US$2, which is an excess of collateral value over the loan value.

In the example above, with a 2% haircut, the repo seller can only receive up to 98% of US$109,898,438 or US$107,700,469, leaving a margin of US$2,197,969. With this buffer, even if the repo seller defaults or the market value of the collateral drops from US$109M to US$108M, the cash lender still has enough to recoup the loan.

Fig 4: Haircuts of various collateral in Tri-party Repo (FRBNY)

It should be evident that the more risky/illiquid the asset is, the higher haircut it commands.

Variation Margin

Supposedly the value of the collateral falls from US$109M to US$108M, against the US$107M loan. The repo seller receives a margin call and is required to post additional treasuries/cash worth US$1M to the cash provider to replenish the initial margin of US$2M.

One might wonder why entities would be interested in repo transactions. There are a myriad of reasons but generally fall into 4 categories.

1) Cash management/Investing

Due to its collateralized nature, it is a popular avenue for large corporates, pension funds, and MMFs with large cash portfolios to park cash overnight or short term. This is due to the FDIC insurance limit of US$250,000, of which is peanuts compared to their cash accounts. Hence, a repo being a collateralized loan is more attractive and safer than a commercial bank deposit that bears inherent credit risk (i.e. liability of a commercial bank).

2) Long Financing

The use of the repo market to finance the purchase of financial instruments is pretty popular. This is especially so in the broker-dealer market in which entities attempts to use limited balance sheet space to facilitate market making activities. The current model of trading desks is to make small fees across the spread with limited capital. Take for example, the trading desk needs to absorb the sale of bonds from a client. Rather than using its own capital, the trading desk repos out the bond in the repo market. Note that, due to the existence of the haircut, the trading desk is unable to raise the full amount for the payment of the bond. Hence, it is still required to post its capital (though just a few percentage points) to fund the margin.

Fig 5: Long financing of trading desk (Wiley Finance)

Please also do note that the Trading Desk if unhedged is highly levered, given that the transaction is essentially equivalent to purchasing a bond with margin. Alternatively, a hedge fund can also do this same transaction unhedged to gain levered exposure.

3) Short Financing

It is essentially the opposite of long financing. Assuming a hedge fund wants to short a bond. It enters into a reverse repo transaction (think from the perspective of the fund) to acquire the bonds in the repo market. It then sells the bond in the bond market and uses the proceeds to fund the reverse repo transaction.

Fig 6: Short financing of hedge fund (Wiley Finance)

4) Collateral Swap/ Transformation

The preference of more liquid inventories or demand for eligible collateral encourages the swapping of collaterals. Instead of a collateralized loan of cash, it is a collateralized loan of collateral. Take a EM Turkish bank for example, they hold some soft currency bond denominated in Lira and wants to borrow some dollars in the global dollar repo market. However, the Lira bonds are ineligible (i.e. no counterparty wants to hold them). Hence the Turkish bank have to engage in collateral transformation to change its Lira bonds into treasuries. A large pension fund may be happy to sacrifice liquidity temporarily for some extra yield.

Today, we have 2 clear and distinct repo regimes, one in the US and the other one outside the US. While we have detailed statistics about the repo market within the US, not much is known about the offshore global repo market. A key distinction is that the global repo market is not limited by laws on collateral hypothecation while the SEC regulates the number of times the collateral can be reused.

For this piece, let’s focus on the US repo markets. Though imo, the global repo market is more important and fun.

In the US, there are 4 types of repo markets that spawn from various combinations of cleared vs uncleared, Tri-party vs bilateral. In a nutshell, we have 1) Cleared Bilateral, 2) Uncleared Bilateral, 3) Cleared Tri-Party and 4) Uncleared Tri-party.

Fig 7: US Repo Market (Office of Financial Research)

When the repo market was first developed, all transactions were bilateral in nature. However, the bilateral repo has some operational complexities. They require the cash provider to 1) keep track of the securities collateral it receives, 2) make sure that the collateral is valued correctly and 3) the margins are being maintained. All of these require significant operational expertise, especially for agents that deal with lots of counterparties.

To avoid this, the collateral provider can opt to “hold in custody” aka hold the collateral for the cash provider. Once again, it is not really preferred since the cash investor may find it difficult to obtain the securities should there be a counterparty default. These issues are alleviated in the Tri-Party repo market.

Under the Tri-Party model, we have an agent that acts as a middleman to facilitate the transaction. In US, they are Bank of New York Mellon (BONY) and Fixed Income Clearing Corporation (FICC). These collateral management services that they provide eliminate the risk that collateral is sent without receiving payments or vice versa.

At the initiation of the Tri-Party repo transaction, the repo buyer and seller sends the cash, collateral respectively to the agent. The agent, after verifying receipts of cash and collateral then moves them into the respective accounts. Additionally, the agent enforces strict margin requirements as discussed earlier on the different parties.

Let’s dive deeper into each individual market.

Cleared Tri-Party (FICC GCF Repo Service)

In this market, FICC provides both collateral management services and acts as a central clearing counterparty. Additionally, transactions in this market anonymize the identities of lenders and borrowers. General Collateral Finance (GCF) is limited to collateral that can be sent over Fedwire, meaning that only 3 type of collateral are eligible (Treasuries, Agency MBS, and securities). Note that, the GCF repo market is an interdealer/interbank market where securities dealers and large banks fund their inventory.

Uncleared Tri-Party (BONY Tri-Party)

In this market, Bank of New York Mellon (BONY) serves as the tri-party custodian and provides collateral management services but does not serve as a clearing central counterparty. A larger variety of collateral is accepted, including HY corporate debt and even equity at times.

However, in both cases, neither the cash nor the collateral leaves the tri-party platform. Thus, collateral is “locked in” and hence not available for further rehypothecation in the financial market. Rehypothecation is the process where collateral received from one transaction is used again as collateral against borrowing in another transaction.

Cleared Bilateral (FICC DVP Repo Service)

In this market, FICC serves as the counterparty but does not provide collateral custodian services. Like GCF, DVP allows trades only using collateral that can be sent over Fedwire (i.e. Treasuries and Agency collateral). Since counterparties have direct access to the collateral, they can rehypothecate the collateral.

Uncleared Bilateral

As the name suggests, there is no central clearing counterparty nor is there a third-party agent involved. Transactions occur OTC and collateral is normally specified. There are no direct collections of data on this market.

Fig 8: Attributes of the 4 US Repo Markets (OFR)

I hope this piece gives a brief overview of the Repo market. In the next topic, we will delve into collaterals and how it affects the financial world.